Summary

According to the January 2025 Customer Data Platform Industry Update, the CDP industry expanded globally in the second half of 2024, as established companies in Europe and Asia added CDP capabilities to existing product lines.

The Gartner 2025 Magic Quadrant for Customer Data Platforms predicts that by 2028, the data management markets will converge into a single market of a data ecosystem enabled by data fabric and GenAI.

Tracking CDP Market Growth

According to the January 2025 Customer Data Platform Industry Update, industry growth continued steadily. Net CDP employment rose by 675 (a 4% increase) to 17,350 and total funding rose by $988 million (a 13% increase) to $8,526 million during the period. Nineteen vendors were added and seven inactive vendors were removed, resulting in a total vendor count of 204.

CDP Industry Revenue Projections

The customer data platform (CDP) market is projected to reach $7.39 billion, with a CAGR of 29.2%. The market is expected to continue this growth trajectory, reaching $23.98 billion by 2029 at a CAGR of 34.2%, according to The Business Research Company.

CDPs Still Attracting Investment

According to the January 2025 Customer Data Platform Industry Update, new companies struggle to attract funding. There were two large funding events but both went to established firms: a $500 million Series E for Insider and $408 million debt offering for Informatica. Over all, companies founded after 2014 account for just 11% of industry funding despite comprising 25% of the vendor count.

Also according to the January 2025 Customer Data Platform Industry Update, acquisitions are back. The period saw four CDP acquisitions, compared with none in the previous report. Most notably, two industry pioneers were acquired by companies selling customer-facing systems: ActionIQ was purchased by conversation processing vendor Uniphore, which made it a foundation of a “zero data AI cloud”, and Lytics was purchased by content management and digital experience platform ContentStack. mParticle was purchased by Rokt just after the period ended.

How Big is the CDP Market by Vendor?

In addition to total industry revenue, the CDP Institute tracks industry size by the number of vendors in the space, as well as the number of employees at those vendors who are dedicated to CDP-specific offerings. Occasionally, the CDP Institute removes vendors from their list due to a clearer understanding of their products or as a result of changes in the products or in the company’s business. When companies are removed by CDP Institute, they are excluded from prior period analysis.

Added vendors were established firms. All but one of the 19 added vendors was founded before 2019, and 16 are campaign or delivery CDPs. These characteristics generally indicate that a company added a CDP to an existing product. The employment share of firms established before 2008 actually increased, from 24% one year ago to 27% in the current report.

What is The Size of the CDP Market by Employee Headcount?

Employment growth came from new vendors in the Customer Data Platform Industry Update: January 2025 report. New vendors accounted for 728 employees and $72 million in financing. The employment count for existing vendors was essentially flat. By contrast, $915 million of the $988 million funding increase came from existing vendors.

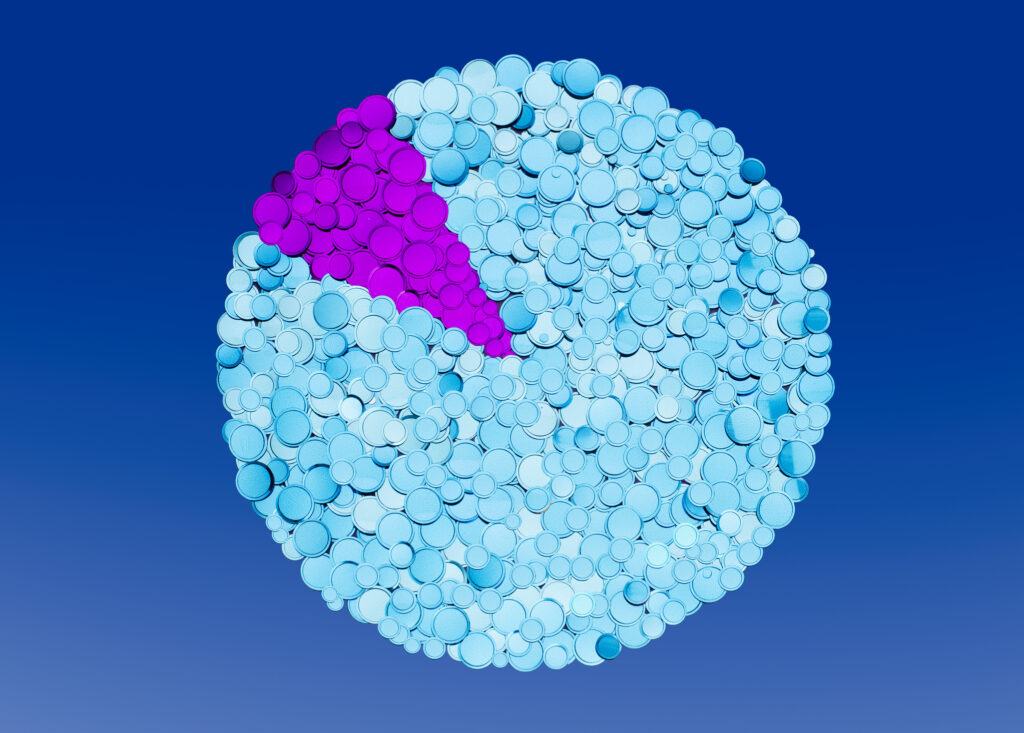

What Is The Size of the CDP Market By Region?

According to the January 2025 Customer Data Platform Industry Update, most industry growth was outside the United States. Only two of the added firms were based in the U.S., compared with nine in Asia, seven in Europe, and one in Latin America. The Americas share fell to 45% of firms, 61% of employment, and 82% of funding, while the APAC share grew in all categories.

For the most up-to-date information on the CDP Industry, check out these 2025 reports from Gartner and Forrester, courtesy of Treasure Data.

- 2025 Magic Quadrant for Customer Data Platforms (Gartner)

- This is 2nd Magic Quadrant for the CDP industry. The Gartner Magic Quadrant for Customer Data Platforms reveals the relative position of 12 technology providers for CDPs. https://www.treasuredata.com/i/gartner-mq/ (Note: Reg. required)

- 2025 Critical Capabilities for Customer Data Platforms (Gartner)

- In the 2025 Gartner Critical Capabilities for Customer Data Platforms report, you can evaluate 12 CDP vendors and their capabilities to determine which platform is right for your Use Cases. https://www.treasuredata.com/i/gartner-cc/ (Note: Reg. required)

- The Forrester Wave™: Customer Data Platforms For B2C, Q3 2024

- Check out the new 2024 Forrester Wave research report on CDPs for the B2C market. Download a complimentary copy of The Forrester Wave™: Customer Data Platforms For B2C, Q3 2024, courtesy of Treasure Data.